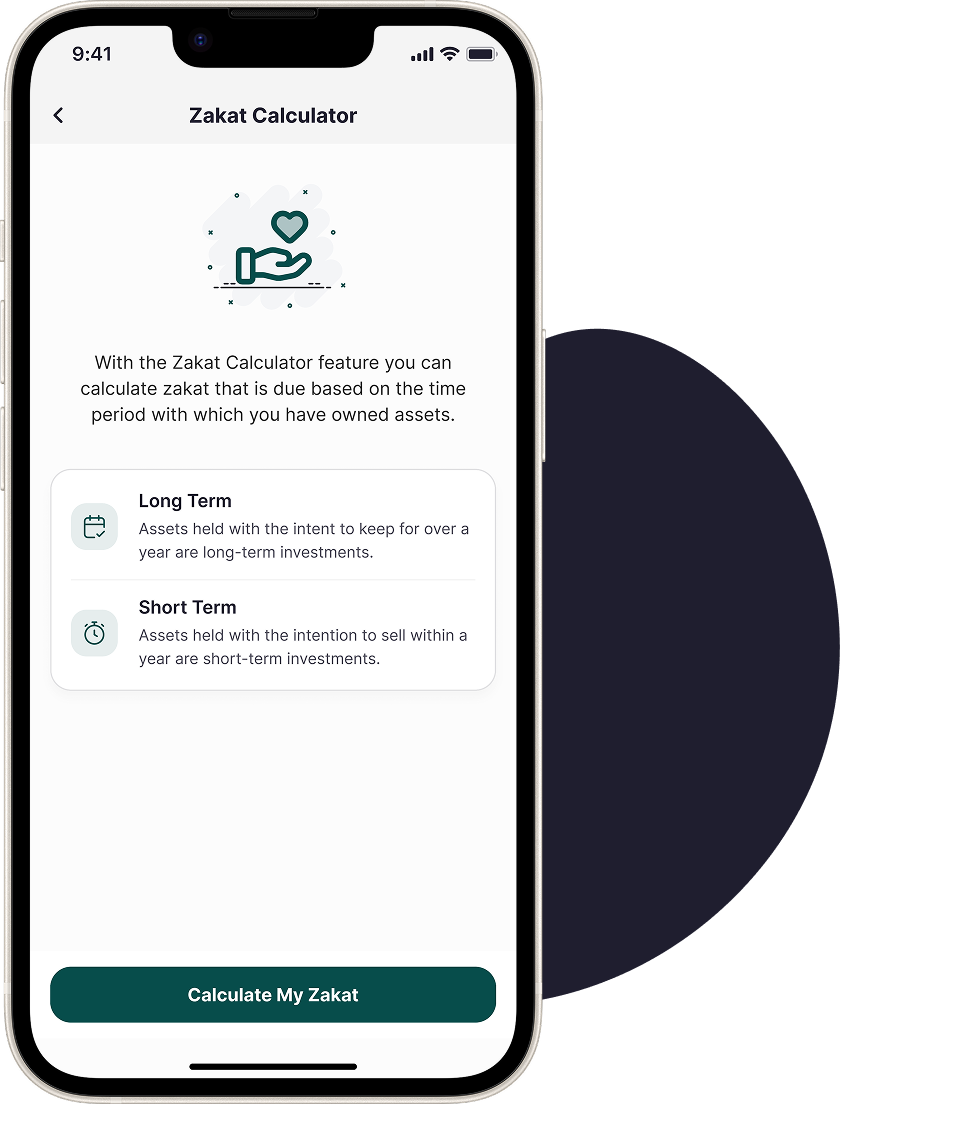

Calculate your zakat obligations with clarity using Zakat Calculator

With the Zakat Calculator feature you can calculate zakat that is due based on the time period with which you have owned assets.

Zakat on Stocks Guide

Zakat on Stocks

Shares are a type of asset that represents ownership in companies, and by nature, they are capable of growth through profits and returns. Accordingly, the owner of these shares is obligated to pay zakat on them, provided that the Shariah conditions are met, considering them as growing wealth subject to zakat like other invested funds.

Conditions

For zakat to be obligatory on shares, their value must reach the nisab (minimum threshold), which is equivalent to 85 grams of gold or its monetary equivalent, and a full lunar year must have passed since owning them. The method of calculating zakat differs depending on the purpose of owning the shares.

Intention of Ownership

If the shares are owned for speculation (short-term investment), zakat is due on the market value of the investment. However, if the shares are owned for long-term investment, zakat is due on the profits or dividends received.

Easiest Way To Zakat Calculation

Easiest Way To Zakat Calculation

Open the Zakat Calculator from the settings tab

Easily manage your Zakat calculations directly from the Settings tab.

Start choosing your short- or long-term stocks

Select the stocks that match your short-term moves or long-term plans.

Once you've added your stocks, review or them

Double-check your stock selections to ensure they fit your goals.

See your calculated Zakat amount, and recalculate if needed

Easily calculate your Zakat, and adjust it whenever you need.

Invest Abroad,

Right At Home.

Invest in U.S. securities with just a few taps on your mobile screen. After you’ve done your due diligence of course. Which you can and should do through.. Zad.